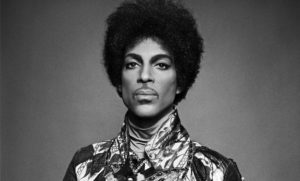

Most recently, Prince joins a list of celebrities who died without a will. Tupac Shakur, Bob Marley, and so many other legendary musicians have passed without securing their estates.

It begs the question: Why?

It seems like such a basic concept; everyone needs a will. Otherwise the laws of the state you live in determine who receives your assets and controls your legacy after you die. Without a will, you have no say in what happens, and the chances of a family fight increase dramatically.

Even though a will is relatively simple to create, studies consistently show that Continue reading