Year-end Tax Tip. Avoid taxes on an #RMD with a #charitabledonation. Seniors who have a traditional 401(k) or #IRA account must take a required minimum distribution each year once they reach age 70 1/2. Those who don’t need this money for living expenses may want to consider having it sent directly to a charity as a qualified charitable distribution. “If you take it out as a qualified charitable distribution, it doesn’t increase your adjusted gross income,” says Mike Piershale, president of Piershale Financial Group in Crystal Lake, Illinois. “It can also hold down the amount of# that is taxed.”

Year-end Tax Tip. Avoid taxes on an #RMD with a #charitabledonation. Seniors who have a traditional 401(k) or #IRA account must take a required minimum distribution each year once they reach age 70 1/2. Those who don’t need this money for living expenses may want to consider having it sent directly to a charity as a qualified charitable distribution. “If you take it out as a qualified charitable distribution, it doesn’t increase your adjusted gross income,” says Mike Piershale, president of Piershale Financial Group in Crystal Lake, Illinois. “It can also hold down the amount of# that is taxed.”

Tag Archives: Election year

Simple Ways to Save Money #4

One of the best ways to save money is to set a goal. Start by thinking of what you might want to save for—anything from a down payment for a house to a vacation—then figure out how long it might take you to save for it.

One of the best ways to save money is to set a goal. Start by thinking of what you might want to save for—anything from a down payment for a house to a vacation—then figure out how long it might take you to save for it.

Continue reading

Year-End Tax Tip

I Wonder…?

Is This You?

Bees are buzzing on rooftops at 7 San Francisco hotels

San Francisco (AP) – At the Clift Hotel in San Francisco, there are more than 370 rooms inside and 100,000 bees buzzing above in rooftop hives outside.

San Francisco (AP) – At the Clift Hotel in San Francisco, there are more than 370 rooms inside and 100,000 bees buzzing above in rooftop hives outside.

Yes, honeybees.

Aware of the well-publicized environmental threats to honey bees that have reduced numbers worldwide, 7 San Francisco hotels have built hives on the rooftops. The sustainability efforts also benefits the hotels as the bees produce honey for cocktails, food and spa treatments. It’s the latest in a series of environmental programs at hotels that includes low-flow toilets and aggressive recycling programs.

“This is not about making money, it’s really about raising awareness about sustainability”, said Melissa Farrar, spokesman at the Fairmont in San Francisco. “There’s not one solution so we wanted to do our part to help. It’s part of the bigger effort for helping the planet.” Farrar said the four hives on the rooftop garden support about 250,000 bees and produce about 1,000 pounds of honey each year.

Kristin J. Bender

The Importance of Having a Will

Most recently, Prince joins a list of celebrities who died without a will. Tupac Shakur, Bob Marley, and so many other legendary musicians have passed without securing their estates.

It begs the question: Why?

It seems like such a basic concept; everyone needs a will. Otherwise the laws of the state you live in determine who receives your assets and controls your legacy after you die. Without a will, you have no say in what happens, and the chances of a family fight increase dramatically.

Even though a will is relatively simple to create, studies consistently show that Continue reading

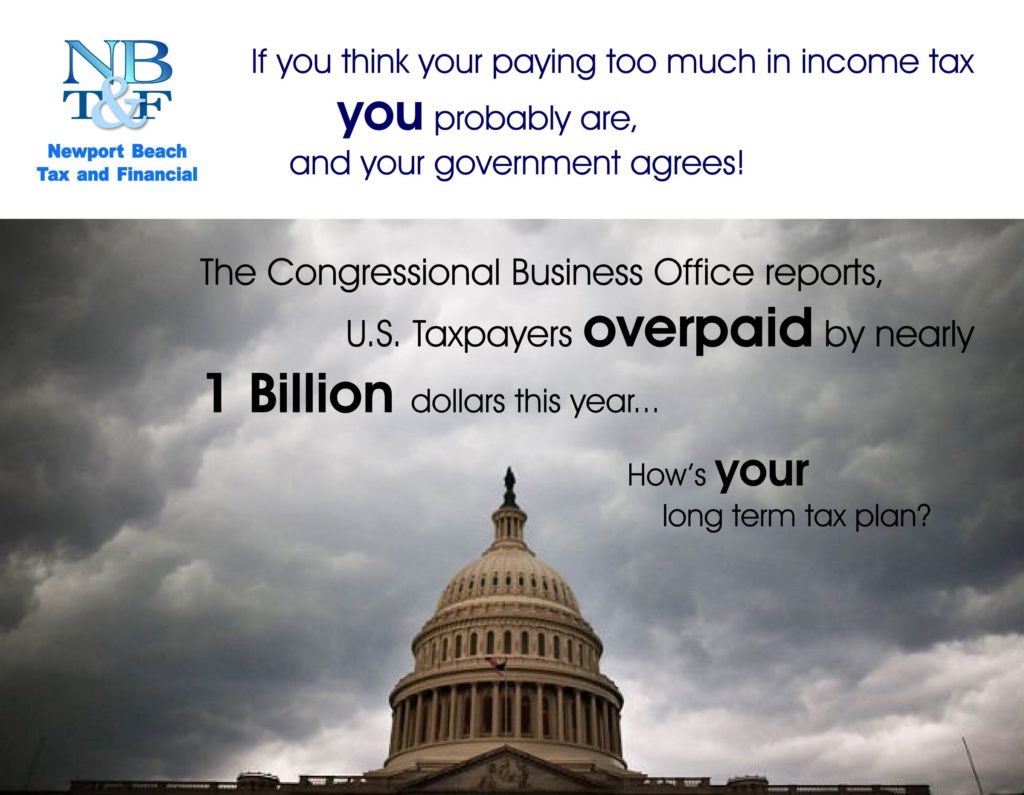

Setting priorities in an election year

Election-year politics will dominate legislative action in 2016 as both parties seek to lay out policy agendas for 2017 and beyond, which would seem to dim prospects for legislation in 2016. However, despite divided government during 2015, Congress enacted several key pieces of legislation. Will the legislative successes of 2015, including the signing of a major December ‘tax extender’ bill, and Paul Ryan’s elevation to Speaker of the House create momentum that can be carried over into enactment of additional meaningful legislation during 2016? Will the House or the Senate introduce further tax reform legislation setting the stage for 2017?

Election-year politics will dominate legislative action in 2016 as both parties seek to lay out policy agendas for 2017 and beyond, which would seem to dim prospects for legislation in 2016. However, despite divided government during 2015, Congress enacted several key pieces of legislation. Will the legislative successes of 2015, including the signing of a major December ‘tax extender’ bill, and Paul Ryan’s elevation to Speaker of the House create momentum that can be carried over into enactment of additional meaningful legislation during 2016? Will the House or the Senate introduce further tax reform legislation setting the stage for 2017?

Newport Beach Tax and Financial will address these topics and more, including tax reform, global tax controversy, IRS challenges, new regulatory projects, and other tax policy matters of importance to today’s business leaders.